What Is A Revocable Living Trust?

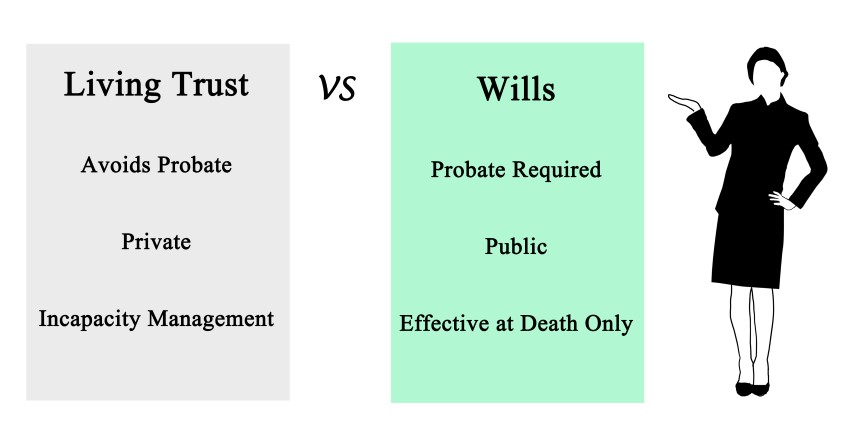

Living trusts are a common alternative to wills, and they provide many benefits that users find very helpful. The most important one is that your assets do not have to go through probate court proceedings upon your death, which makes things easier on your family and other loved ones, saving both time and money. With a living trust, your assets transfer directly to one trust holder, who then distributes them to the beneficiaries.

In particular, a revocable living trust is a great option if you want more control over how your money is spent after you pass on. In a revocable living trust, you can add provisions regarding how your money is spent and how it is to be distributed. You can continue to make changes to the trust as you go through your life, which allows you to best accommodate for your financial situation at any given time. You can also take into account what the best interests would be for your beneficiaries depending on their current situation.

You can also use a trust to make sure that your money is well managed for years to come by appointing a professional trustee or leaving detailed instructions on how the money is to be invested or spent. In many cases, you’ll want your children and their families to be cared for throughout their entire lives, and for them to have an inheritance that they can pass on to their children someday as well. However, not everyone is naturally comfortable or smart with money, and you may worry about leaving your finances in their hands. You can sidestep this problem by leaving detailed provisions that ensure that your finances are managed the way you want them to be. This is particularly important for things like investments, where your beneficiaries may not have the same level of financial expertise that you do and may not be comfortable managing the investments in the same way. It is also important for large sums, particularly if they are intended for things such as education or the continual management of a family business.

When putting together a revocable living trust, you’ll need to establish a complete list of the assets you would like to go into the trust, who you would like your beneficiaries to be, and how you would like the assets to be distributed and maintained. This is a lengthy process that can take time to do properly, so it is important to get started as soon as possible if you are considering using a trust to leave assets to your children. You will also need to decide who the trust holder will be upon your passing. This is a very important decision that should not be taken lightly. This person should have the ability to distribute and manage all of your assets accordingly and should be willing to take on the responsibility. Many people choose a professional trust holder in this case to ensure that everything is taken care of properly. You’ll also need to fund the trust to make sure all of the assets are in the right name so that they can be distributed quickly and without interference from probate court upon your passing.

Since the process of putting together a revocable living trust can be very challenging and overwhelming, the best course of action is often to consult a lawyer during this process, particularly one that has expertise and experience with living trusts. Lawyers can easily review your documents to make sure that everything is legal and that there are no errors that could cause potential problems later on down the line.