What Assets Can You Put In A Trust?

Trusts are an asset management tool that can help you ensure that your money and your investments remain in your family or are managed according to your wishes. There are a variety of different types of trusts for different situations. Many people use trusts as a way to transfer their assets after they pass away, to give money to their children or relatives as they grow up, or to give money to charity. Trusts are also a good way to legally avoid certain property taxes, particularly if your net worth is high.

There are a variety of different types of assets that you can put in a trust. Although the legality differs for each type of trust, in this article we’ll talk about living trusts just to simplify things. Living trusts are used to distribute assets to beneficiaries after one’s death without having to go through probate court. Living trusts allow your trustee to manage all your assets and ensure that they are distributed according to your wishes. In this sense, they are often used in conjunction with a will.

The first and most obvious asset that you can put in a trust is money. You can do this by putting the contents of a bank account or safe deposit box in your trust. You can then use the trust to distribute the contents of the bank account to your beneficiaries. You should also include real estate in your trust. You can include a variety of different types of real estate, such as commercial real estate or residential real estate. This will allow you to transfer the titles on the property to a beneficiary later on.

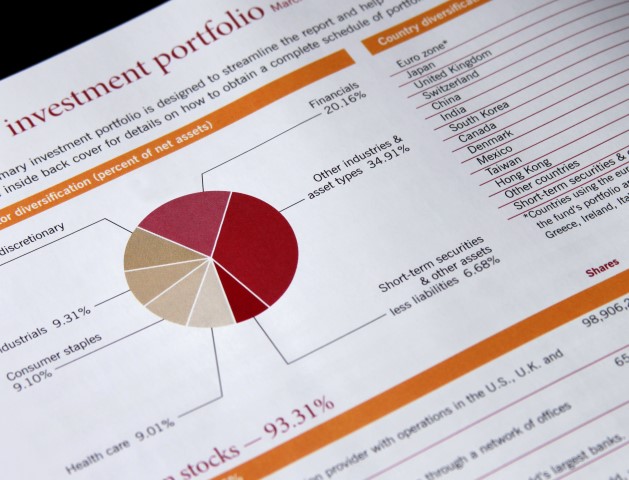

You can also transfer investments you have made into your trusts. These include things like stocks, bonds, investment funds, and more. These investments can grow over time, but by putting the entire investment into your trust, you can ensure that it is managed the way you’d like it to be, regardless of what happens in your life. Control of your investments can transfer to your beneficiaries to ensure they are managed well, instead of being distributed in probate court.

Additionally, any businesses that you own can be placed into the trust. This is similar to transferring real estate to a beneficiary – transferring a business to someone will give them control over it and give them access to all the resources you’d have as the owner. It is important to ensure that you have a plan for your business to continue.

Finally, you can add other items of major financial value to a trust. For example, if you have a very expensive collector’s car, you might want to put that in the trust to make sure that it continues to be maintained after you pass on. Although most people likely won’t have a major investment piece such as this to put into a trust, it is important to be aware that this is an option you can use to manage your property.

In order to make sure you keep control of your assets while you are still alive, you will need to name yourself as a trustee for your living trust. You can have multiple trustees on an account, so you should name yourself as the primary trustee and then have someone else on the trust that it will transfer to later on. If you don’t name yourself as a trustee, you will be giving up certain controls and access to your assets. To ensure that this entire process is handled legally and effectively, it may help to work with an experienced estate lawyer.